Sustainable Conformal Coating Protection

Global regulations are driving industries to minimise the use of chemicals. Increasing environmental responsibility demands we use our products for longer. P2i’s clients use plasma conformal coatings to increase product life-cyles and reduce costs. In addtion, manufacturing yields increase and costs reduce. These ultra-thin coatings deliver many competitive advantages for our customers.

Scale of the Problem Today

- As the human race, we scrap 1 in 5 electronic devices every year.

- We generated 58M tonnes of e-waste in 2021. This outweighs the Great Wall of China, and is is projected to grow to 75M tonnes by 2030 – equal to 8.8 kg per capita.

- We only recycle 17% of e-waste each year.

- Over 900,000 smartphones suffer preventable liquid damage per annum.

- E-waste contains several toxic additives, posing risks to our environment and human health.

Conformal Coating Solutions

P2i’s unique technology offering works at the molecular level. This delivers the thinnest, most robust liquid protection on the market. This approach allows us to enhance any solid surface and maximise protection.

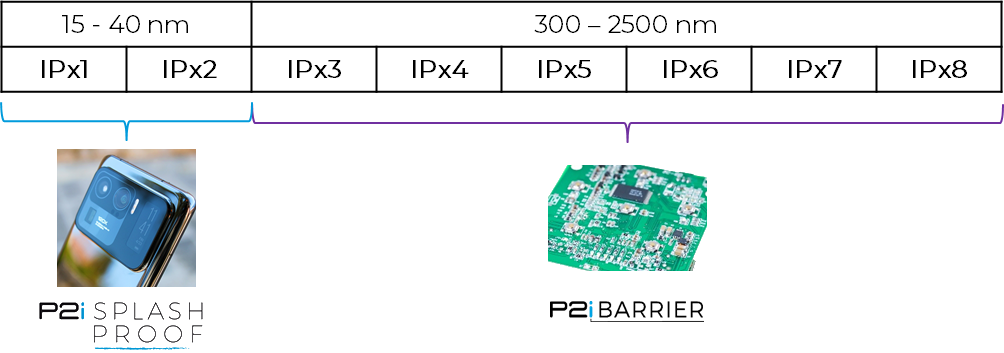

Our ultra-thin barrier coatings offer the full range of liquid and environmental protection. This includes achieving IPx1-IPx8+ for electronic devices.

We achieve this full range by delivering both liquid repellency and barrier properties.

Splash-proof is a complete device-level repellent coating. Applied to the finished product at the end of the assembly line, before package and ship. This protects the device from liquid ingress from splashes and spills.

Barrier is a PCBA level electrical insulating layer. Applied post Surface Mount Technology (SMT) line, before final assembly. This protects treated PCBAs from corroding following exposure to harsh environments and immersion.

Conformally Coated Products

P2i specialises in protecting electronics at a lower total cost to current methods. This increases product life cycles, decreases waste and enables the circular economy. Our customers use ultra-thin barrier conformal coatings to adopt reduce, reuse, recycle strategies.

News

In the dynamic world of consumer electronics, where innovation drives progress and demands are ever evolving, one critical aspect often...

Read MoreIn the ever-evolving landscape of electronic device protection, and the need to meet the right-to-repair requirements, one method stands out...

Read More1 In 5 electronic products are disposed of annually and only 20% are formally recycled. Driven by the need to...

Read MoreGet in Touch

Once we've received your inquiry, one of our team will contact you to understand your needs, target performance criteria and timelines for implementation. We can then discuss sampling so you can evaluate our technology and claims for yourself.

We look forward to hearing from you.